- Low price

- Extensive contextual help

- No restrictions on federal forms

- No import or photo capture for W-2 or 1099s

- State returns cost extra

- No live chat without upgrade

- Text-heavy interface

FreeTax USA lets you e-file your federal tax return, no matter which IRS forms or schedules you need, at no cost at all. A state return will run you $15. An additional, optional $8 will cover a Deluxe add-on that includes live support, amended returns and audit assistance.

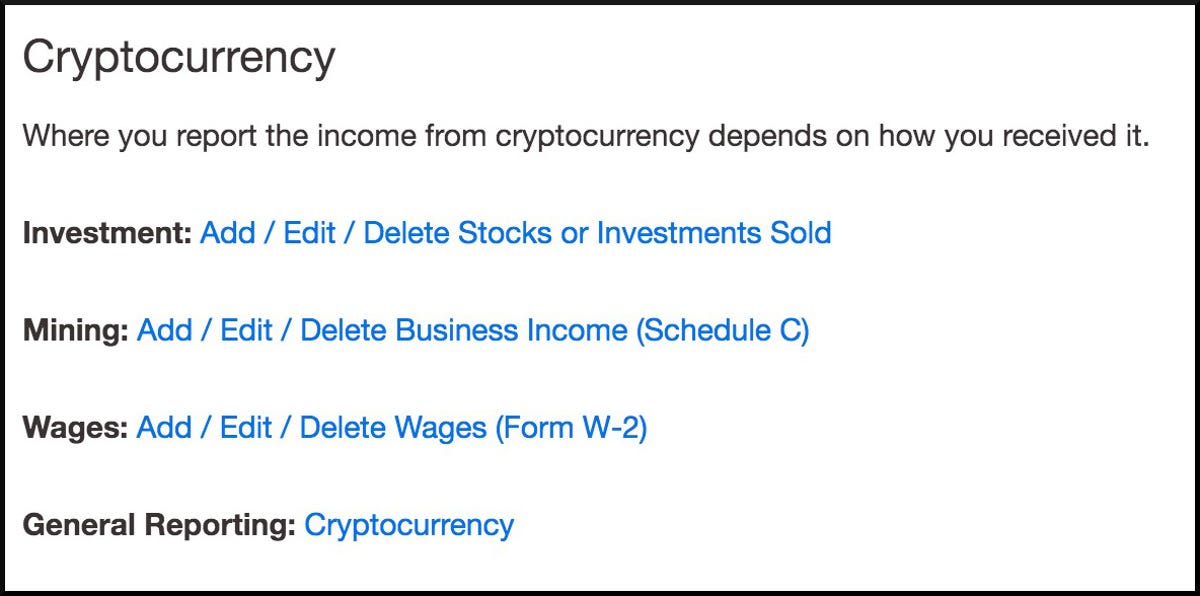

With a clean interface, solid support features and an efficient question-and-answer process. FreeTaxUSA offers good value for a low price tag. Even if you have unemployment income, crypto sales, rental property, retirement distributions, health savings accounts or all of the above, FreeTaxUSA lets you file your taxes for free.

FreeTaxUSA isn’t as approachable as tax software like H&R Block or TurboTax, our top pick for best tax software in 2023, nor does it have the same level of professional help and support. It’s also not completely free like Cash App Taxes, but FreeTaxUSA is a thorough, efficient and robust low-cost option.

Who should use FreeTaxUSA?

Self-employed filers looking for a cheap way to file their taxes could be well served by FreeTaxUSA. Tax prep plans for gig workers and freelancers are usually the costliest commercial software (top pick TurboTax’s Self-Employed plan runs $168 for federal and state, while H&R Block’s currently costs $133). While FreeTaxUSA doesn’t let you import multiple 1099 forms, you can enter as many as you want, completely free.

FreeTaxUSA may also appeal to filers who don’t mind reading a lot. The interview questions are well organized and the help content is comprehensive, but there are no graphical or design elements to break up long sections of words.

Tax filers who received long-term care or death benefits, usually from an insurance company or the government, also should consider FreeTaxUSA -- it includes support for Form 1099-LTC, which isn’t available in similar free tax software.

And, if you earned significant money in other countries, FreeTaxUSA includes Form 1116 for claiming the foreign tax credit, another form not usually included in free tax software.

Who shouldn’t use FreeTaxUSA?

FreeTaxUSA does not allow foreign employment income. Other rare tax situations not covered by FreeTaxUSA include nonresident alien returns (Form 1040NR), at-risk limitations (Form 6198), casualty or theft gain or loss from a business or donations of property over $5,000

If you’re looking for free live chat features, want more one-on-one tax support or are looking for a completely free tax filing option, this option may not be the best for you.

How does FreeTaxUSA work?

Like most other tax software, FreeTaxUSA starts you off by either importing a PDF of your prior year’s tax return or collecting your personal information via the online form. Aside from this, there’s no other option to upload files so if you’re a freelancer with multiple 1099 forms, you’ll have to input the information manually.

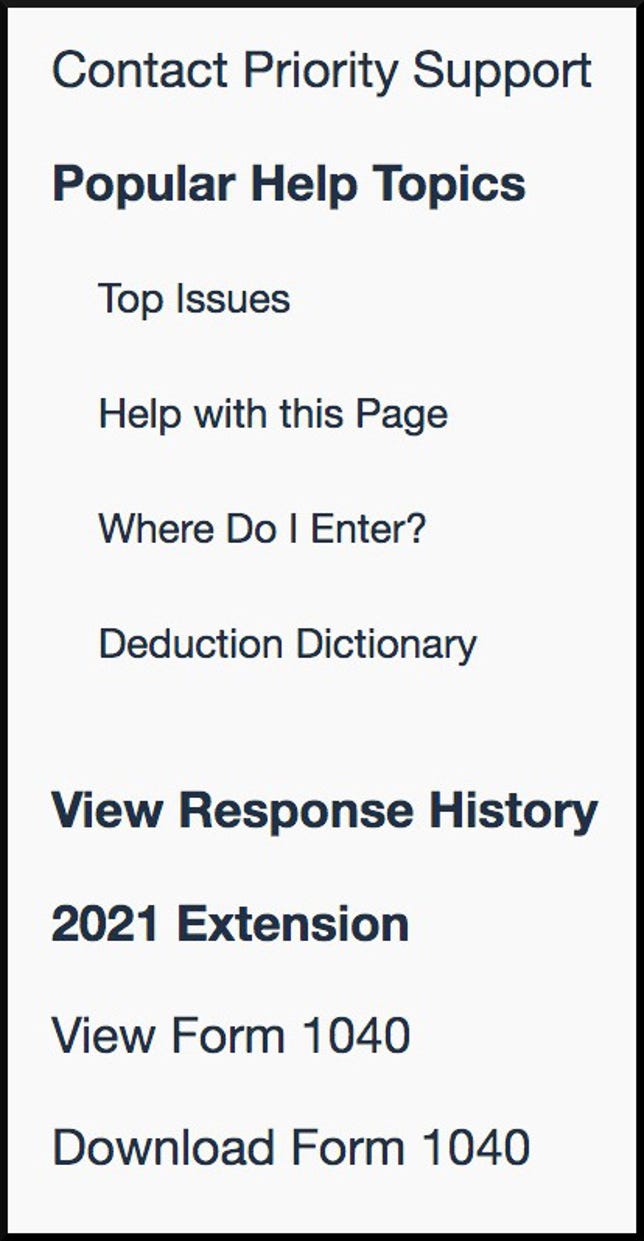

FreeTaxUSA’s integrated help features are impressive -- contextual question marks provide valuable, straightforward information in popovers that don’t spawn new tabs or browser windows. A useful Help with this page link provides all the support answers related to the particular section of the tax return you’re currently completing.

Click Where Do I Enter? for shortcuts to pages where you can enter specific tax details. You can also use the Deduction Dictionary to get specific information on how to claim and where to record 127 different tax deductions and credits.

While FreeTaxUSA provides useful tax information, it lacks the graphical interfaces of higher-priced competitors that simplify the process. For example, FreeTaxUSA explains the differences in tax filing statuses, but instead of making a recommendation, it then leaves it up to you to select your filing status. It does make sure to confirm your filing status during the review of your return, since it’s a common mistake in many tax returns.

FreeTaxUSA’s guided question-and-answer process is well-organized and efficient. The software often marks the most likely answers for some of the less common tax questions so you can easily click through forms without selecting every single Yes or No.

The navigation of FreeTaxUSA splits up into personal info, income, deductions, miscellaneous, summary, state return and filing status. The drop-down menus from each section provide a detailed list of what’s included, but you can’t jump ahead to many sections until you reach them via the guided process.

After completing each of the income and deductions sections -- the bulk of your tax return -- FreeTaxUSA provides a helpful screen for reviewing all your details and confirming that every item is correct and nothing has been missed.

You can add Deluxe support features at any time -- you don’t have to pay the $8 until you file. Upgrading to Deluxe unlocks two new buttons in the support section: “Live Chat” and “New Priority Support Issue.” The chat feature is much more rudimentary than TurboTax or H&R block, but I did chat with a representative after waiting 2 to 3 minutes, and he was able to answer simple questions about the software. The live chat feature does not include tax advice, only support for the tax preparation software.

FreeTaxUSA doesn’t have any dedicated mobile apps, but the browser-based mobile version works well. Data from my return synced instantly between my mobile device and computer.

What products does FreeTaxUSA offer?

FreeTaxUSA markets its tax software like other products with four levels of service: Basic for simple tax returns; Advanced for itemized deductions; Premium for investment income and property and Self-Employed for freelancers, contractors and gig workers. The big difference with FreeTaxUSA is that all of the plans are completely free.

The plans all run the same software. Once you get into the tax preparation process, there are no more mentions of any of those product levels.

The only paid products that FreeTaxUSA sells are state return filing for $15 a piece and a support add-on called Deluxe for $8. The Deluxe service bumps you to the front of the support line, adds live chat and lets you file unlimited amended returns. Deluxe also includes Audit Assist, which will provide help with both in-person and correspondence audits.

Other notable FreeTaxUSA features

FreeTaxUSA keeps an old-school bookmark tag on every page of the tax return process, letting you mark specific sections or pages to complete or review later. I like the feature in general, but it wasn’t ideal for me and didn’t always work correctly.

FreeTaxUSA displays a running total of your expected refund, which is similar to other software. But it uniquely includes a link to your 1040 form as you complete your taxes, letting you easily preview or download the form as it currently stands.

FreeTaxUSA lets you pay your filing fees (if you have any) by taking money from your tax refund, but there is a charge. FreeTaxUSA does not offer any refund advance loan opportunities. You can receive your refund with FreeTaxUSA by direct deposit, check in the mail or transfer to a prepaid debit card.

A maximum refund guarantee promises a refund and a coupon for an amended tax return if any other tax filing method results in a larger refund. An accuracy guarantee ensures that FreeTaxUSA will reimburse you for any penalties or interest that result from any miscalculation in the software.

FreeTaxUSA also offers a Refund Maximizer feature that reviews your existing deductions and forms and asks additional questions that might increase your refunds. It includes a helpful checklist of IRS forms you may have missed, but the feature overall is not as slick or as integrated as TaxAct’s similar Deduction Maximizer feature.

Summary

FreeTaxUSA’s comprehensive tax software will help almost any taxpayer file their taxes at no cost. It doesn’t provide the sort of hand-holding and expert support that top tax software does, but it includes well-organized and contextual tax help that provides many answers to common tax questions.

The support features of FreeTaxUSA pale in comparison to more expensive products, but their relative cost is far less. While tax filers will still need to run through the gauntlet of usual tax questions, FreeTaxUSA’s clean, stripped-down process lets them get the job done quickly and efficiently. Its unrestricted offerings for all tax filers at no cost make it worthy of consideration by anyone looking to file their taxes on the cheap.

Compare other tax software:

- Best Tax Software for 2023

- TurboTax Review

- H&R Block Review

- TaxSlayer Review

- Cash App Taxes Review

- Jackson Hewitt Review

- TaxAct Review

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.